Trading Volumes Drop While CME Open Interest Climbs 28.6% - CryptoCompare Analysis

Despite Bitcoin’s rally to $14k towards the end of the month, October saw spot trading volumes drop by 17.6% across the board. CME had an impressive month with open interest climbing 28.6%, signalling growing demand for Bitcoin from institutional traders. However, overall derivatives volumes declined slightly, experiencing a 2.4% drop since September.

Below are some of the key highlights from CryptoCompare's October Exchange Review, including a new open interest analysis.

Key Highlights

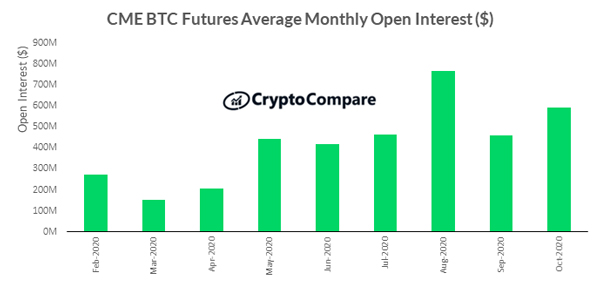

Open Interest from CME grew 28.6% in October

Institutional open interest remained high, with $0.82bn of open interest on CME. The average open interest on CME increased 28.6% to $593bn in October.

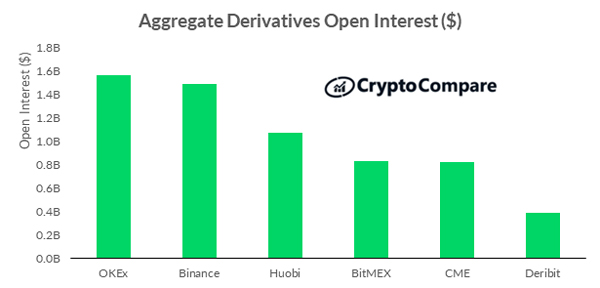

OKEx derivatives led in open interest

At the end of October, OKEx had the highest open interest across all derivatives products at $1.56bn. This was followed by Binance ($1.49bn), Huobi ($1.07bn), and BitMEX ($0.83bn).

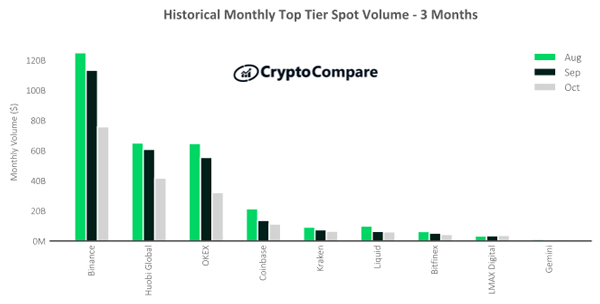

Large decreases in monthly spot trading volumes seen for many top-tier exchanges

Binance (Grade A) was the largest Top-Tier exchange by volume in October, trading $75.7bn (down 33.1%). This was followed by Huobi Global (Grade BB) trading $41.7bn (down 31.4%), and OKEx (Grade BB) trading $32.1bn (down 42.0%). Exchanges Coinbase (AA), Kraken (A), and Liquid (A) followed with $11.3bn (down 17.5%), $6.5bn (down 13.0%) and $6.1bn (down 4.3%).

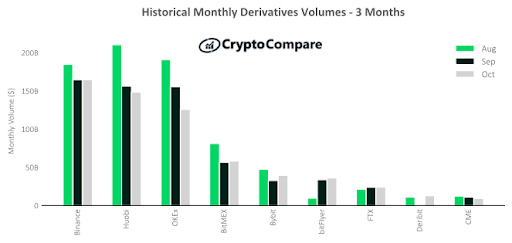

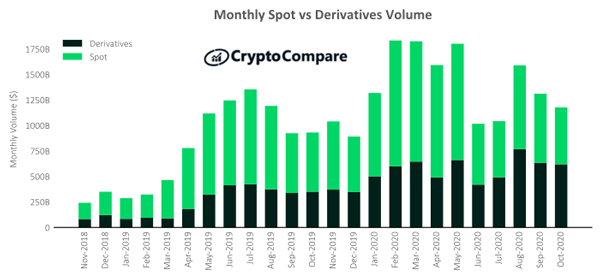

Monthly derivatives volumes remained relatively stable in October while spot volumes declined

Derivatives volumes decreased 2.4% in October to $619.9bn. Meanwhile, total spot volumes decreased by 17.6% to $557.7bn.

Binance led in terms of monthly derivatives volume in October, followed by Huobi, OKEx and BitMEX

Binance was the largest derivatives exchange in October by monthly trading volume with $164.8bn (up 0.02% since September). Huobi (down 5%), OKEx (down 19.16%) and BitMEX (up 3.41%) followed with $148.4bn, $125.8bn and $58.3bn traded respectively.