Nasdaq Private Market Reports $1.7 Billion In Transaction Value In First Six Months Of 2020 - 29 Private Company-Sponsored Transactions Completed Amid Pandemic-Related Market Slowdown

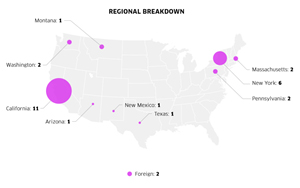

Chart detailing regional breakdown of NPM's private company clients.

|

- Strongest first quarter for transactions in Nasdaq Private Market history

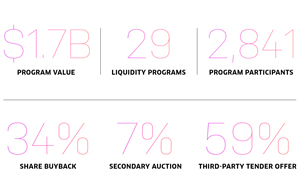

The Nasdaq Private Market, LLC, a leading provider of liquidity solutions for today’s private companies, has published its Mid-Year Private Company Report, which summarizes private company liquidity activity on the Nasdaq Private Market platform for the first six months of 2020. Nasdaq Private Market facilitated 29 private company-sponsored secondary transactions during the period, with total transaction value of $1.7 billion.

“As more transaction activity on our platform resumes following the initial months of the pandemic, we expect the secondary market to grow, providing more opportunities for private companies and their shareholders to access liquidity,” said Eric Folkemer, Head of Nasdaq Private Market. “As private companies evaluate the timing of their secondary transactions, Nasdaq Private Market remains ready to help them meet their liquidity needs.”

Additional findings from the 2020 Mid-Year Private Company Report include:

- Record start: Nasdaq Private Market set a new record in the first quarter, facilitating the most transactions for the three month period in its history, fueled in part by the strong transaction momentum observed in late 2019.

- Early-stage companies drive transaction volume: Nearly half of the 29 programs completed (48%) were for early-to-mid-stage companies (Series D funding round or earlier) – a strong indication that liquidity programs are happening much earlier in a company’s pre-IPO lifecycle.

- Transactions by unicorns: 10 companies valued at $1 billion or above completed liquidity transactions during the period, indicating unicorns’ continued usage of the Nasdaq Private Market platform.

- Buyer evolution: 1H20 saw a steady rise in third-party tender offers, at 65% of total programs.

Founded in 2013, Nasdaq Private Market’s solutions support private companies throughout all stages of their pre-IPO lifecycle. Our innovative technology facilitates company-sponsored tender offers, share repurchases, and block trades to provide eligible shareholders access to liquidity. Since inception, Nasdaq Private Market has supported liquidity programs involving 44,230 shareholders at 257 private companies, which can have the benefit of providing liquidity for their employees and early investors, whether it be to retain their best talent or to maintain their competitive advantage in the marketplace.

Leveraging Nasdaq’s technology and market operation expertise, Nasdaq Private Market’s centralized continuous trading platform simplifies the transaction process for its clients, providing transparency, regulatory oversight, and structured technology. Our automated settlement solutions can offer real-time consolidated trading data. Our continuous platform offering provides the company and its investors with an ability to keep a finger on the pulse of market supply and demand, helping to drive activities to develop a price benchmark or reference price for potential use on day one of the company’s public listing.

To download the report and speak with a private company liquidity expert, visit www.npm.com.