IHS Markit August Commodity Price Watch: Does The Recent Rise In Commodity Prices Foretell A Full Recovery? - Rebound In Manufacturing Likely A Bounce That Will Be Difficult To Maintain

“Can the momentum in the manufacturing sector be sustained, with prices rising further over the near-term? To be sure, the rise in prices highlighted by the four-month rally in the IHS Markit Materials Price Index does indicate the worst of the recession globally is over. But the continuing increase in COVID-19 case counts globally, and the re-imposition of containment measures even in regions that had seemingly beat-back the pandemic, underscores what is likely to be the start-stop pattern to growth.” – John Mothersole, pricing and purchasing research director, IHS Markit

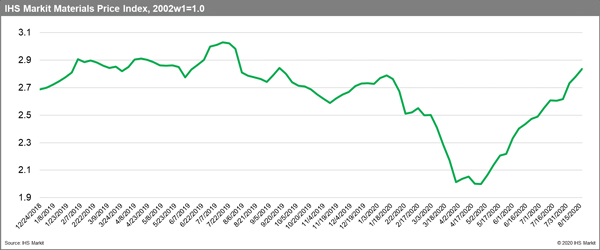

Commodity prices have staged an impressive rebound between April and mid-August. As measured by the IHS Markit Materials Price Index (MPI), prices have erased their first quarter plunge during the last four months and are now up 3.4% for the year.

Why the quick recovery? A combination of factors seems to be at play: the strong performance of the Chinese economy, production cuts (oil) or supply disruptions (copper), a weaker US dollar, huge government stimulus and even hope for a vaccine late this year. Pent-up demand, changes in consumer spending patterns and business inventory management are also contributing to the rebound in manufacturing activity, supporting prices.

For consumers, suppressed spending on many activities (travel, restaurants, entertainment) is channeling purchasing towards goods (and saving), with much of the pent-up demand from earlier this year being released now. Businesses have helped boost the apparent consumption of commodities by replenishing stocks run down during the first half of the year. Firms also seem to want higher inventory in their supply chains because of disruptions, a decision made easier by low financing costs.

“In terms of physical consumption, our caution is that the rise in commodity prices does not foretell a full recovery in 2020 or even 2021, as the damage to labor markets worldwide has been too great. Goods markets have benefited – temporarily -- from the change in behavior. The question is, will consumers embark on a fresh round of goods purchases with labor markets still weak and government transfers being dialed back? We think it unlikely. Likewise, the boost to apparent consumption from inventory restocking will be difficult to sustain unless firms feel comfortable with even higher inventory sales ratios, which in some industries already look elevated, even granting a desire to hold higher buffer stocks.

In short, we think the rebound in manufacturing is more likely a bounce (albeit welcomed) that will be difficult to maintain. Likewise, the run-up in material prices since April has been impressive. However, do not expect the momentum to carry across the rest of 2020.” – John Mothersole, pricing and purchasing research director, IHS Markit