Eurex Exchange's Quarterly Equity Derivatives Highlights - Q2/2020

Market wrap-up

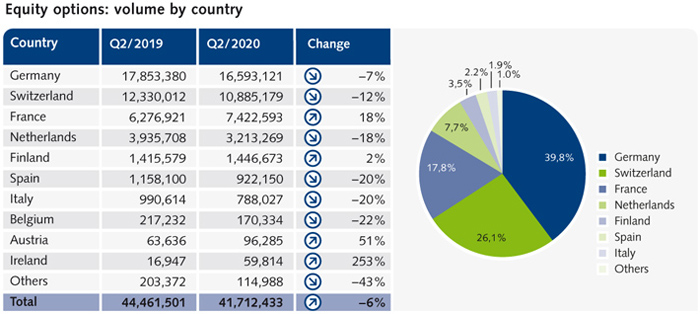

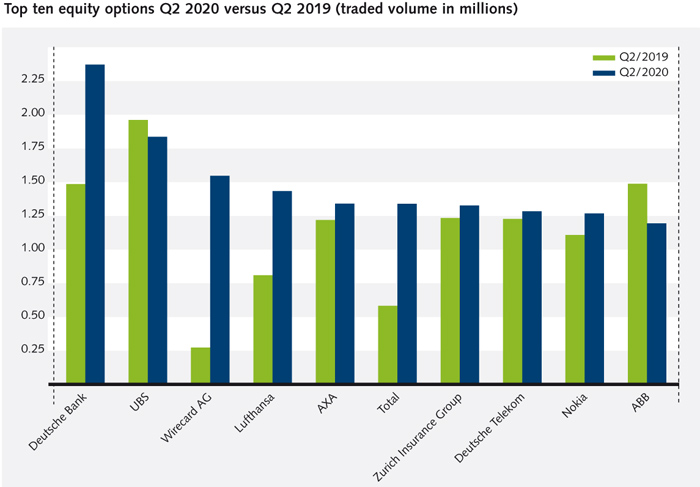

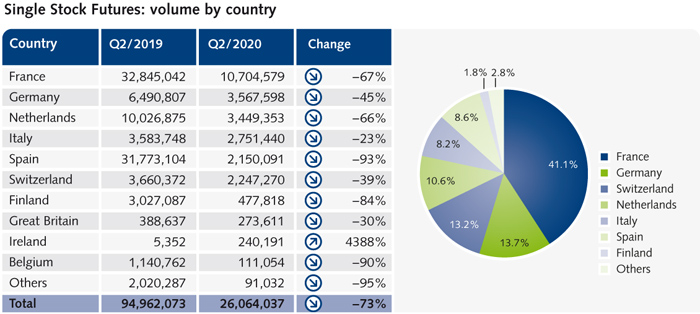

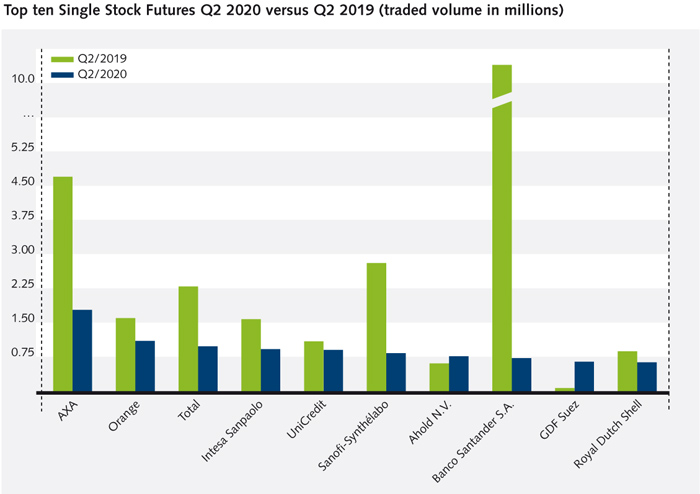

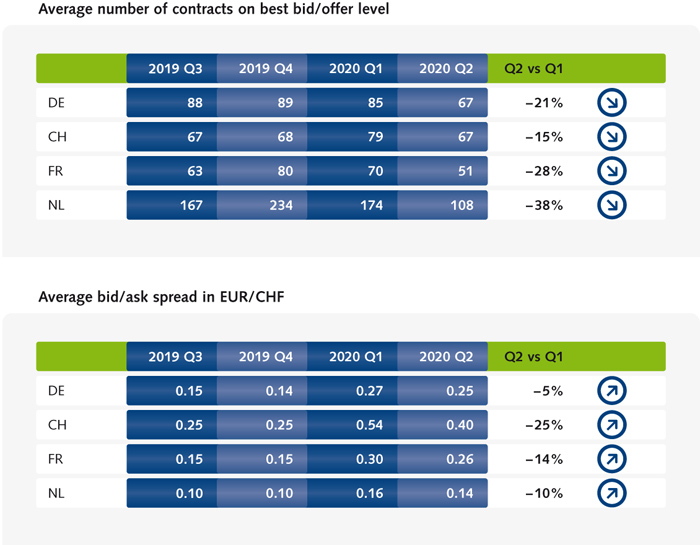

After the extreme Q1 market volatility, equity derivatives market slowly calmed down following several monetary and fiscal measures by national banks and governments. Whereas the overall market saw a tremendous recovery rally in the second quarter, the situation on a single stock level is still driven by uncertainty on earnings, dividends and local shutdowns. Whereas volumes in single stock options have seen a slight decrease quarter on quarter, the overall trend in 2020 is still up with a plus of more than 6% for the first half-year vs. last year.

Due to the high volatility at the end of the first quarter, Eurex implemented several measures, including the relaxation of required spreads for specific underlyings to guarantee orderly markets and available liquidity. The scope of those measures slowly narrows as uncertainty and volatility decrease.

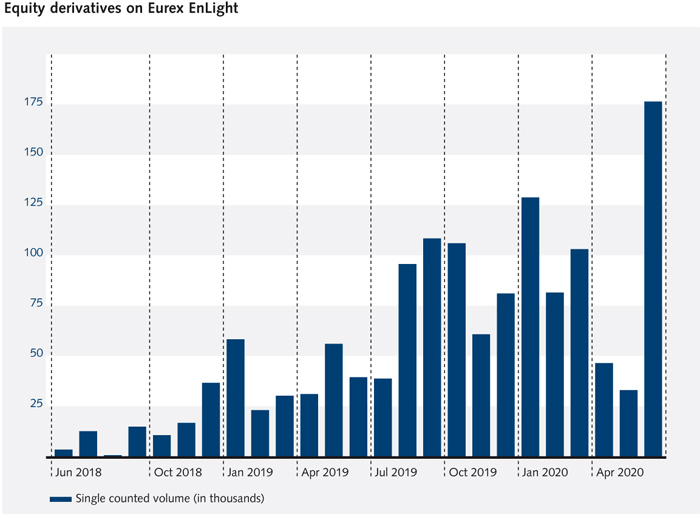

In June, Eurex EnLight recorded a record month in terms of traded volumes in Single Stock Options. With the T7 release 8.1 by the end of June, the new anonymous negotiation functionality has been implemented. The functionality allows the requester to stay anonymous throughout the negotiation process. In August this year, the Smart RfQ functionality will go live. It will support the requester to find the right liquidity provider based on historical quoting performance and volume statistics in a specific underlying. The smart list will suggest the six top responders in a certain underlying based on the previous 90-day performance. Especially in the single stock options market, the functionality will improve access to unknown liquidity providers.

Starting from 22 June, Related Security Spread "RSS" Futures are available for trading at Eurex. This new, innovative product allows you to trade the spread between related securities, such as dual listings or different share classes, in listed format via a spread ratio. Investors benefit from ease of execution, cash settlement, fixed notional / FX neutral exposure, reduced costs and increased transparency. The majority of pairs have been quoted onscreen by our partner and market maker, Maven Securities.