ETFGI Reports Year-To-Date Net Inflows Into ETFs And ETPs Listed Globally At The End Of Q3 Are At A Record Level Of US$ 488.18

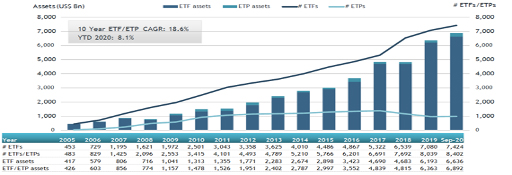

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs and ETPs listed globally gathered net inflows of US$59.74 billion during September, bringing year-to-date net inflows to record level of US$488.18 billion which is significantly higher than the US$349 billion gathered at this point last year. Assets invested in the global ETFs/ETPs industry decreased by 1.8%, from US$7.01 trillion at the end of August 2020, to US$6.89 trillion at the end of September, according to ETFGI's September 2020 Global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs and ETPs listed globally gathered net inflows of $59.74 billion during September.

- Year-to-date net inflows at the end of Q3 are at a record level of US$ 488.18 billion.

- Equity ETFs/ETPs listed globally attracted the highest inflows among the asset classes with

$36.64 billion during September. - Commodities ETFs/ETPs gathered year-to-date net inflows of $70.25 billion, much higher than the $18.19 billion had attracted by this time last year.

- Assets declined to $6.89 trillion invested in ETFs/ETPs listed globally at the end of September the 2nd highest level on record.

“The S&P 500 declined 3.8% in September, with concerns over back-to-school (and resulting COVID cases), U.S. elections and stimulus talks. Strong prior month gains boosted the index higto close up 8.9% for Q3. Global equities declined 3.1% in September, as measured by the S&P Global BMI. Despite the monthly decline, the global benchmark managed to finish Q3 up 8.1% Q3 and up 0.7% YTD. Emerging markets, declined 2.2% in September but closed up 9.0% for Q3.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of September 2020

The Global ETF/ETP industry had 8,402 ETFs/ETPs, with 16,627 listings, assets of $6.89 Trillion, from 487 providers listed on 73 exchanges in 59 countries at the end of September 2020.

During September 2020, ETFs/ETPs gathered net inflows of $59.74 billion. Equity ETFs/ETPs listed globally gathered net inflows of $36.64 billion over September, bringing net inflows for 2020 to $174.44 billion, higher than the $132.69 billion in net inflows equity products had attracted during September 2019. Fixed income ETFs/ETPs listed globally reported net inflows of $10.93 billion during September, bringing net inflows for 2020 to $171.56 billion, more than the $171.38 billion in net inflows fixed income products had attracted over September 2019. Active ETFs/ETPs reported $8.24 billion in net inflows bringing net inflows for 2020 to $51.48 billion, which is much greater than the $29.41 billion in net inflows reported through September 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $36.22 billion during September, the iShares Core S&P 500 ETF (IVV US) gathered $3.89 billion alone.

Top 20 ETFs by net new inflows September 2020: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

iShares Core S&P 500 ETF |

|

IVV US |

211,987.51 |

7,259.01 |

3,894.75 |

|

Invesco QQQ Trust |

|

QQQ US |

135,714.21 |

18,431.77 |

3,769.45 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

161,857.54 |

17,941.48 |

3,752.93 |

|

Vanguard Total International Stock Index Fund ETF |

|

VXUS US |

26,218.79 |

8,458.48 |

2,291.43 |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

|

511990 CH |

18,193.60 |

2,272.86 |

2,272.86 |

|

Vanguard Total Bond Market ETF |

|

BND US |

62,278.25 |

11,223.25 |

1,962.22 |

|

iShares Core U.S. Aggregate Bond ETF |

|

AGG US |

80,896.61 |

8,086.85 |

1,938.47 |

|

Guotai CES Semi-conductor Industry ETF - Acc |

|

512760 CH |

1,982.83 |

3,011.93 |

1,901.02 |

|

Vanguard Total International Bond ETF |

|

BNDX US |

32,425.99 |

7,151.14 |

1,834.18 |

|

ProShares UltraPro QQQ |

|

TQQQ US |

8,775.46 |

937.60 |

1,684.25 |

|

Vanguard S&P 500 ETF |

|

VOO US |

16,0023.80 |

17,934.37 |

1,610.89 |

|

KraneShares CSI China Internet ETF |

|

KWEB US |

2,832.83 |

2,195.00 |

1,167.10 |

|

NEXT FUNDS TOPIX Exchange Traded Fund |

|

1306 JP |

12,0864.29 |

20,399.99 |

1,135.70 |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

29,3891.30 |

(29,615.04) |

1,118.81 |

|

Vanguard Short-Term Corporate Bond ETF |

|

VCSH US |

32,706.31 |

6,207.37 |

1,053.62 |

|

Vanguard Value ETF |

|

VTV US |

51,050.59 |

2,411.52 |

1,022.27 |

|

iShares 20+ Year Treasury Bond ETF |

|

TLT US |

19,094.45 |

(1,633.48) |

1,018.97 |

|

iShares China CNY Bond UCITS ETF |

|

CNYB NA |

2,246.21 |

2,082.79 |

975.87 |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

71,276.18 |

3,426.50 |

942.31 |

|

E FundSI Artificial Intelligence ETF |

|

159819 CH |

852.20 |

872.36 |

872.36 |

The top 10 ETPs by net new assets collectively gathered $4.90 billion over September. The SPDR Gold Shares (GLD US) gathered $1.12 billion alone.

Top 10 ETPs by net new inflows September 2020: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

GLD US |

75,827.44 |

21,165.19 |

1,117.39 |

|

iShares Physical Gold ETC - Acc |

SGLN LN |

15,283.65 |

5,903.86 |

983.69 |

|

iShares Gold Trust |

IAU US |

31,430.00 |

9,073.29 |

809.41 |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

13,981.77 |

4,735.13 |

767.63 |

|

Invesco DB US Dollar Index Bullish Fund |

UUP US |

740.61 |

551.85 |

335.96 |

|

MicroSectors FANG+ Index 3X Leveraged ETNs due January 8, 2038 |

FNGU US |

862.55 |

236.21 |

236.21 |

|

Invesco Physical Gold ETC - EUR Hdg Acc |

SGLE IM |

185.91 |

178.13 |

176.60 |

|

SPDR Gold MiniShares Trust |

GLDM US |

3,561.27 |

2,010.65 |

169.39 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

XGDU LN |

182.09 |

180.34 |

153.69 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

3,872.09 |

2,269.88 |

149.95 |

Investors have tended to invest in Equity and Fixed Income ETFs/ETPs during September.