ETFGI Reports ETFs And ETPs Listed Globally Gathered Net Inflows Of US$65 Billion US Dollars During June 2020

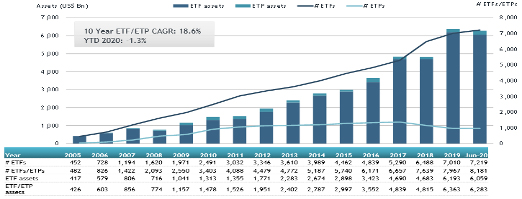

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs and ETPs listed globally gathered net inflows of US$64.96 billion during June, bringing year-to-date net inflows to US$294.48 billion which is significantly higher than the US$209.51 billion gathered at this point last year. Assets invested in the global ETFs/ETPs industry have increased by 2.8%, from US$6.11 trillion at the end of May 2020, to US$6.28 trillion at the end of June, according to ETFGI's June 2020 Global ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $6.28 trillion invested in ETFs/ETPs listed globally at the end of June are the 3d highest on record.

- Fixed Income ETFs/ETPs listed Globally attracted the highest net inflows among the asset classes with $38.97 billion during June.

- Commodities ETFs/ETPs gathered year-to-date net inflows of $53.85 billion, much higher than the $3.51 billion attracted at this time last year.

“The S&P 500 gained 1.99% during June. In Q2, U.S. equities staged a recovery from the Q1’s decline. Although Covid cases in the U.S. are still increasing the stimulus from the Fed and Congress, aided the market rebound. During June developed markets outside the U.S. were up 3.44% and up 16.8% in Q2. In June Hong Kong (up 11.35%), New Zealand (up 10.09%) Netherlands (up 8%) and Germany (up 6.08%) as the top performers. Emerging markets gained 7.6% in June and are up 19.3% in Q2.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of June 2020

At the end of June 2020, the Global ETF/ETP industry had 8,181 ETFs/ETPs, with 16,377 listings, assets of $6.283 trillion, from 468 providers listed on 72 exchanges in 59 countries.

During June, ETFs/ETPs gathered net inflows of $64.96 billion. Equity ETFs/ETPs listed globally reported net inflows of $16.90 billion during June, bringing net inflows for 2020 to $88.88 billion, more than the $78.04 billion in net inflows equity products had attracted through June 2019. Fixed income ETFs/ETPs listed globally gathered net inflows of $38.97 billion at the end of month, bringing net inflows for 2020 to $105.83 billion, lower than the $113.22 billion in net inflows fixed income products had attracted year to date in 2019. Commodity ETFs/ETPs reported $5.18 billion in net inflows bringing net inflows for 2020 to $53.58 billion, which is much greater than the $3.51 billion in net inflows reported through June 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $47.70 billion at the end of June, the Vanguard S&P 500 ETF (VOO US) gathered $6.84 billion alone.

Top 20 ETFs by net new inflows June 2020: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Vanguard S&P 500 ETF |

|

VOO US |

145567.24 |

17574.75 |

6835.52 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

|

VCIT US |

35777.24 |

8974.34 |

5606.04 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

|

LQD US |

54025.02 |

15562.87 |

3346.21 |

|

SPDR Gold Shares - Acc |

|

GLD US |

65948.90 |

15635.11 |

3153.38 |

|

JPMorgan BetaBuilders Europe ETF |

|

BBEU US |

5172.66 |

2112.38 |

2838.91 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

|

HYG US |

26776.93 |

8696.32 |

2390.90 |

|

SPDR Bloomberg Barclays Intermediate Term Treasury ETF |

|

SPTI US |

4059.88 |

2912.79 |

2250.52 |

|

Vanguard Short-Term Corporate Bond ETF |

|

VCSH US |

28764.22 |

2606.01 |

2213.61 |

|

iShares Core U.S. Aggregate Bond ETF |

|

AGG US |

75500.80 |

2821.70 |

2170.42 |

|

iShares Intermediate-Term Corporate Bond ETF |

|

IGIB US |

10710.48 |

892.50 |

1993.36 |

|

Vanguard Total Bond Market ETF |

|

BND US |

55933.20 |

4924.53 |

1964.38 |

|

JPMorgan BetaBuilders Japan ETF |

|

BBJP US |

4784.71 |

700.35 |

1945.67 |

|

iShares Core S&P Small-Cap ETF |

|

IJR US |

40065.68 |

542.78 |

1679.80 |

|

JPMorgan BetaBuilders International Equity ETF |

|

BBIN US |

1706.85 |

1670.44 |

1638.50 |

|

JPMorgan Ultra-Short Income ETF |

|

JPST US |

12782.38 |

2508.79 |

1364.38 |

|

Listed Index Fund TOPIX |

|

1308 JP |

50678.82 |

8551.08 |

1330.35 |

|

Schwab US TIPS ETF |

|

SCHP US |

10391.84 |

1142.48 |

1324.79 |

|

TOPIX Exchange Traded Fund |

|

1306 JP |

109643.17 |

15342.75 |

1292.85 |

|

iShares Core S&P 500 ETF |

|

IVV US |

192593.62 |

4018.29 |

1202.77 |

|

SPDR Dow Jones Industrial Average ETF |

|

DIA US |

21394.01 |

1165.20 |

1157.72 |

The top 10 ETPs by net new assets collectively gathered $6.79 billion in June. The SPDR Gold Shares - Acc (GLD US) gathered $3.15 billion alone.

Top 10 ETPs by net new inflows June 2020: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares - Acc |

GLD US |

65,948.90 |

15,635.1 |

3,153.38 |

|

iShares Gold Trust - Acc |

IAU US |

25,917.55 |

5,229.67 |

794.69 |

|

iShares Silver Trust - Acc |

SLV US |

8,880.90 |

2,170.46 |

624.52 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

3,404.21 |

2,041.91 |

573.36 |

|

Xtrackers IE Physical Gold ETC Securities - GBP Hdg Acc |

XGDG LN |

3.05 |

318.76 |

318.50 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

845.62 |

462.32 |

309.02 |

|

SPDR Gold MiniShares Trust - Acc |

GLDM US |

2,521.09 |

1,131.39 |

294.33 |

|

VelocityShares Daily 2x VIX Short Term ETN - Acc |

TVIX US |

1,150.09 |

1,542.45 |

277.77 |

|

Xetra Gold EUR - Acc |

4GLD GY |

12,593.06 |

993.58 |

258.56 |

|

Xtrackers Physical Silver ETC (EUR) - Acc |

XAD6 GY |

609.68 |

241.24 |

180.91 |

Investors have tended to invest in Fixed Income and Equity ETFs/ETPs at the end of June.