ETFGI Reports Assets Invested In Leverage And Inverse ETFs And ETPs Listed Globally Reached A Record US$89.64 Billion At The End Of July 2020

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported that assets invested in Leverage and Inverse ETFs and ETPs listed globally reached a record US$89.64 billion at the end of July. Leveraged and Inverse ETFs and ETPs gathered net inflows of US$203 million during July and YTD gathered net inflows of US$20.56 billion which is significantly more than the YTD net outflows of US$3.4 billion during 2019 and the full year 2019 net outflows of US$4.13 billion, according to ETFGI’s July 2020 Leveraged and Inverse ETF and ETP industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in Leverage and Inverse ETFs and ETPs listed globally reach a record $89.64 Bn at end of July.

- YTD Leverage and Inverse ETFs and ETPs listed globally gathered net inflows of $20.56 Bn which is significantly more than the YTD net outflows of US$3.4 Bn during 2019 and the full year 2019 net outflows of US$4.13 Bn.

“The S&P 500 gained 5.5% during July. Totally the market is 1.25% up during the first month of Q3 which overcome the historical collapse of pandemic. During July the tech giants achieved again a great month. Developed markets outside the U.S. were up 3.04%. In July, the three Scandinavian countries Norway (up 10.78), Sweden (up 10.11) and Finland (up 9.18) were the leaders. Emerging markets gained 8.47% in July and are up 19.86% in Q3.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

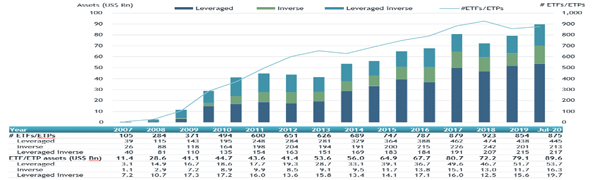

At the end of July 2020, the Global leveraged/inverse ETF/ETP industry had 875 ETFs/ETPs. Of these 875 ETFs/ETPs, 445 were leveraged products, while 213 were inverse listings, and 217 were Leveraged/Inverse.

Global leveraged/inverse ETF and ETP asset growth as at the of end of July 2020

The majority of assets were invested in Leveraged ETFs/ETPs with $53.7 billion, followed by Leveraged/Inverse products with assets of $19.7 billion and Inverse with $16.3 billion.

The largest market for leveraged and inverse ETFs/ETPs is the United States, which, at the end of July 2020, had assets of $54 Bn invested in 243 ETFs/ETPs.

The Samsung KODEX 200 Futures Inverse 2X ETF – Acc gathered $2.22 Bn alone, the largest net inflow year-to-date to July.

Top 20 ETFs/ETPs by YTD net new assets July 2020: Leveraged and Inverse

|

Name |

Country Listed |

Ticker |

Assets |

ADV |

NNA |

Leverage |

|

Samsung KODEX 200 Futures Inverse 2X ETF - Acc |

South Korea |

252670 KS |

2,178.32 |

680.69 |

2,223.14 |

Leveraged Inverse |

|

ProShares Short S&P500 |

US |

SH US |

3,045.25 |

252.50 |

1,995.46 |

Inverse |

|

ProShares Ultra DJ-UBS Crude Oil |

US |

UCO US |

1,431.82 |

208.68 |

1,686.90 |

Leveraged |

|

ProShares UltraPro Short QQQ |

US |

SQQQ US |

1,257.48 |

704.28 |

1,625.64 |

Leveraged Inverse |

|

ProShares UltraPro Short S&P 500 |

US |

SPXU US |

1,050.88 |

340.53 |

1,488.12 |

Leveraged Inverse |

|

YUANTA Daily Taiwan Top 50 -1X Bear ETF |

Taiwan |

00632R TT |

3,014.89 |

57.44 |

1,398.81 |

Inverse |

|

Direxion Daily S&P 500 Bear 3X Shares |

US |

SPXS US |

903.72 |

259.79 |

1,288.58 |

Leveraged Inverse |

|

NEXT NOTES Nikkei JPX Leveraged Crude Oil ETN - Acc |

Japan |

2038 JP |

1,541.82 |

22.80 |

1,282.41 |

Leveraged |

|

VelocityShares 3x Long Crude Oil ETN - Acc |

US |

UWT US |

0.00 |

0.00 |

1,201.97 |

Leveraged |

|

Yuanta S&P GSCI Crude Oil 2X Leveraged ER Futures ETF - Acc |

Taiwan |

00672L TT |

114.57 |

1.63 |

1,104.03 |

Leveraged |

|

ProShares UltraPro Short Dow30 |

US |

SDOW US |

669.60 |

286.54 |

872.43 |

Leveraged Inverse |

|

NEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund - Acc |

Japan |

1357 JP |

3,427.19 |

413.67 |

848.08 |

Leveraged Inverse |

|

ProShares UltraShort S&P500 |

US |

SDS US |

1,270.59 |

255.49 |

831.38 |

Leveraged Inverse |

|

Direxion Daily Financial Bull 3x Shares |

US |

FAS US |

1,537.70 |

133.16 |

828.34 |

Leveraged |

|

Direxion Daily Small Cap Bear 3x Shares |

US |

TZA US |

664.08 |

589.61 |

737.05 |

Leveraged Inverse |

|

Samsung KODEX Inverse ETF |

South Korea |

114800 KS |

971.60 |

176.99 |

663.61 |

Inverse |

|

Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares |

US |

GUSH US |

456.83 |

117.17 |

593.98 |

Leveraged |

|

Direxion Daily MSCI Brazil Bull 2x Shares |

US |

BRZU US |

202.00 |

32.32 |

475.82 |

Leveraged |

|

NEXT FUNDS Nikkei 225 Inverse Index ETF |

Japan |

1571 JP |

739.89 |

14.53 |

459.07 |

Inverse |

|

NEXT FUNDS Nikkei 225 Leveraged Index ETF |

Japan |

1570 JP |

2,003.72 |

1,130.75 |

447.18 |

Leveraged |