ETFGI reports assets invested in ETFs and ETPs listed in US reach a record US$4.61 trillion at the end of July 2020

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today assets invested in ETFs and ETPs listed in US reach a record US$4.61 trillion at the end of July. ETFs and ETPs listed in US gained net inflows of US$37.19 billion during July, bringing year-to-date net inflows to US$226.27 billion which is much higher than the US$150.54 billion net inflows gathered at this point last year. Assets invested in the US ETFs/ETPs industry have increased by 6.2%, from US$4.34 trillion at the end of June, to US$4.61 trillion, according to ETFGI's July 2020 US ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $4.60 trillion invested in ETFs/ETPs listed in US at the end of July are the highest on record.

- During July 2020, ETFs/ETPs listed in US attracted $37.19 billion in net inflows with Fixed Income products being the most attractive among all asset classes.

- Year-to-date net inflows of $226.27 billion are much higher than the $150.54 billion gathered YTD 2019 and is the second highest YTD NNA behind only 2017 which had $275.33 Bn in net inflows.

“The S&P 500 gained 5.6% in July, aided by the U.S. Federal Reserve stimulus and strong earnings. International markets also gained, with Developed Ex-U.S. and Emerging up 3.0% and 8.5%, respectively. In the developed markets Scandinavian countries benefited most, led by Norway (up 10.8%) and Sweden (up 10.1%); while Japan (down 2.0%) was the sole negative performer among developed countries. Dollar weakness contributed toward the positive momentum in Emerging markets where 19 of 25 countries gained, led by Brazil (up 14.4%) and Pakistan (up 13.4%), while Taiwan (up 12.1%) neared an all-time high.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

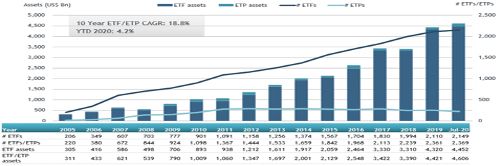

Growth in US ETF and ETP assets as of the end of July 2020

At the end of July 2020, the US ETF/ETP industry had 2,369 ETFs/ETPs, assets of US$4,606 trillion, from 160 providers on 3 exchanges.

During July 2020, ETFs/ETPs gathered net inflows of $37.18 Bn. Fixed income ETFs/ETPs listed in US reported net inflows of $24.30 Bn during July, bringing YTD net inflows for 2020 to $107.86 Bn, more than the $73.10 Bn in net inflows during the corresponding period in 2019. Commodities ETFs/ETPs listed in US attracted net inflows of $7.69 Bn during July, bringing YTD net inflows for 2020 to $40.10 Bn, much higher than the $2.49 billion in net inflows in 2019. Equity ETFs/ETPs saw net inflows of $906 Mn in July, bringing year to date net inflows to $40.83 Bn, which is less than the net inflows of $65.60 Bn over the same period last year. Active ETFs/ETPs gathered net inflows of $5.30 Bn, bringing the YTD net inflows to $24.96 Bn for 2020, which is higher than the $10.2 Bn in net inflows for the corresponding period in 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $25.92 Bn during July. The iShares Core U.S. Aggregate Bond ETF gathered 3.49 Bn alone.

Top 20 ETFs by net new assets July 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

80,083.65 |

6,313.14 |

3,491.44 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

30,741.23 |

11,183.88 |

2,487.56 |

|

Vanguard Total Bond Market ETF |

BND US |

58,997.91 |

7,096.62 |

2,172.09 |

|

SPDR Bloomberg Barclays High Yield Bond ETF |

JNK US |

12,841.38 |

1,106.01 |

1,782.44 |

|

Vanguard Total Stock Market ETF |

VTI US |

151,863.47 |

12,188.02 |

1,645.09 |

|

Vanguard Total International Bond ETF |

BNDX US |

29,820.75 |

4,603.80 |

1,594.30 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

22,697.11 |

5,204.74 |

1,233.18 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

LQD US |

57,445.24 |

16,767.82 |

1,204.95 |

|

iShares Short-Term Corporate Bond ETF |

IGSB US |

19,214.02 |

5,606.94 |

1,175.66 |

|

Vanguard Short-Term Bond ETF |

BSV US |

25,829.47 |

2,338.99 |

1,121.26 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

VCIT US |

37,835.01 |

10,030.73 |

1,056.39 |

|

iShares TIPS Bond ETF |

TIP US |

22,232.79 |

-35.17 |

1,055.02 |

|

Invesco QQQ Trust |

QQQ US |

124,113.00 |

12,575.74 |

901.50 |

|

Vanguard Short-Term Corporate Bond ETF |

VCSH US |

29,963.98 |

3,451.51 |

845.50 |

|

Xtrackers Harvest CSI 300 China A-Shares ETF |

ASHR US |

2,287.08 |

209.67 |

739.50 |

|

iShares J.P. Morgan USD Emerging Markets Bond ETF |

EMB US |

15,823.12 |

206.16 |

729.01 |

|

ARK Innovation ETF - Acc |

ARKK US |

6,132.35 |

2,398.52 |

703.63 |

|

iShares National Muni Bond ETF |

MUB US |

18,199.70 |

2,476.23 |

683.09 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

20,617.78 |

-980.86 |

663.61 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

13,440.17 |

3,140.51 |

631.71 |

The top 10 ETPs by net new assets collectively gathered $9.17 billion during July. The SPDR Gold Shares - Acc

(GLD US) gathered $3.75 Bn alone.

Top 10 ETPs by net new assets July 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares - Acc |

GLD US |

77,278.85 |

19,385.72 |

3,750.61 |

|

iShares Gold Trust - Acc |

IAU US |

31,041.40 |

7,366.86 |

2,137.19 |

|

iShares Silver Trust - Acc |

SLV US |

13,669.52 |

3,632.19 |

1,461.73 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

1,218.41 |

142.14 |

604.47 |

|

SPDR Gold MiniShares Trust - Acc |

GLDM US |

3,239.81 |

1,544.84 |

413.46 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN - Acc |

VXX US |

885.52 |

-908.63 |

294.49 |

|

Aberdeen Physical Swiss Gold Shares - Acc |

SGOL US |

2,611.91 |

932.38 |

159.64 |

|

Invesco CurrencyShares Euro Currency Trust |

FXE US |

345.59 |

47.48 |

126.68 |

|

ProShares Ultra Silver |

AGQ US |

566.72 |

133.43 |

122.94 |

|

Aberdeen Standard Physical Platinum Shares ETF - Acc |

PPLT US |

925.70 |

231.32 |

100.29 |

Investors have tended to invest in Fixed Income ETFs/ETPs during July.