ETFGI Reports Assets Invested In Currency Hedged ETFs And ETPs Listed Globally Reached A Record US$195 Billion At The End Of July 2020

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that assets invested in currency hedged ETFs and ETPs listed globally reached a record US$195 billion at the end of July. Currency hedged ETFs and ETPs listed globally reported net inflows of US$7.57 billion at the end of July bringing year to date net inflows to US$17.04 billion which is significantly more than the US$12.61 billion gathered at this point in 2019, according to ETFGI’s July 2020 Currency hedged ETFs and ETPs industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Total Assets invested in currency hedged ETFs and ETPs listed globally reach a record $195 Bn at the end of July.

- Currency hedged ETFs/ETPs reported net inflows of 7.57 billion at the end of July.

- Currency hedged ETFs and ETPs in Europe account for $104 Bn or 53% of overall assets.

“The S&P 500 gained 5.6% in July, aided by the U.S. Federal Reserve stimulus and strong earnings. International markets also gained, with Developed Ex-U.S. and Emerging up 3.0% and 8.5%, respectively. In the developed markets Scandinavian countries benefited most, led by Norway (up 10.8%) and Sweden (up 10.1%); while Japan (down 2.0%) was the sole negative performer among developed countries. Dollar weakness contributed toward the positive momentum in Emerging markets where 19 of 25 countries gained, led by Brazil (up 14.4%) and Pakistan (up 13.4%), while Taiwan (up 12.1%) neared an all-time high.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

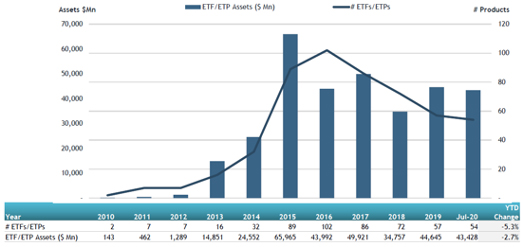

Growth in the US currency hedged ETF and ETP assets as of the end of July 2020

At the end of July 2020, there were 811 currency hedged ETFs/ETPs, with 1,781 listings, there were currency hedged ETFs/ETPs hedged against 15 different currencies, assets of $195 billion, from 77 providers listed on 30 exchanges in 23 countries.

Year to date, 34 new currency hedged ETFs/ETPs were launched by 28 providers across 15 index providers in 14 countries, while 17 products were closed from 9 different providers.

During the month, currency hedged ETFs/ETPs providing exposure to the United States gathered the largest net inflows with $2.49 Bn, followed by mixed exposures with $1.93 Bn and European - Developed exposures with $1.32 Bn, while Asia Pacific – Developed exposures experienced the largest net outflows with $62 Mn. On a year to date basis, currency hedged ETFs/ETPs providing exposure to the United States exposures gathered the largest net inflows with $9.44 Bn, followed by Mixed exposures with $6.5 Bn and Other exposures with $2.33 Bn, while Asia Pacific - Developed exposures experienced the largest net outflows with $2.40 Bn.

The top 10 currency hedged ETFs/ETPs by net new assets collectively gathered $5.36 Bn at the end of July.

The Vanguard Total International Bond ETF (BNDX US) gathered $1.59 Mn, the largest net inflow for the month.

Top 10 ETFs/ETPs by net new assets July 2020: Currency hedged

|

Name |

Ticker |

Assets |

ADV |

NNA |

NNA |

|

Vanguard Total International Bond ETF |

BNDX US |

29,821 |

116 |

4,604 |

1,594 |

|

Xtrackers MSCI USA UCITS ETF (EUR) - Acc |

XD9E GY |

1,018 |

0 |

113 |

805 |

|

UBS ETF (LU) MSCI EMU UCITS ETF (EUR) A - USD Hdg |

EMUUSD SW |

638 |

0 |

674 |

673 |

|

UBS ETF (LU) MSCI EMU UCITS ETF (EUR) A - CHF Hdg Acc |

EMUCHF SW |

536 |

0 |

548 |

548 |

|

Xtrackers MSCI USA UCITS ETF (CHF) - CHF Hdg - Acc |

XD9C SW |

485 |

0 |

(0) |

417 |

|

iShares MSCI World EUR Hedged UCITS ETF (Acc) |

IWDE LN |

3,292 |

19 |

1,111 |

378 |

|

UBS ETF (LU) MSCI Canada UCITS ETF (hedged to USD) A-acc |

CAHUSA SW |

272 |

0 |

28 |

250 |

|

iShares S&P 500 EUR Hedged UCITS ETF (Acc) |

IUSE LN |

4,726 |

15 |

421 |

248 |

|

JPMorgan BetaBuilders US Treasury Bond 0-1 YR UCITS ETF - MXN Hdg - Acc |

MBIL LN |

878 |

0 |

854 |

222 |

|

UBS ETF (LU) MSCI Canada UCITS ETF (hedged to CHF) A-acc |

CAHCHA SW |

241 |

0 |

5 |

220 |