ETFGI Reports Assets In ETFs And ETPs Listed In Europe Reach A New Record Of US$1.08 Trillion At The End Of July 2020

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that assets in ETFs/ETPs listed in Europe reach a new record of US$1.08 trillion at the end of July. ETFs and ETPs listed in Europe reported net inflows of US$17.47 billion during July, bringing year-to-date net inflows to US$50.14 billion which is less than the US$62.65 billion gathered at this point last year. Assets invested in the European ETFs/ETPs industry have increased by 7.7%, from US$1.01 billion at the end of June, to US$1.08 trillion, according to ETFGI's July 2020 European ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets invested in ETFs/ETPs listed in Europe reach a new record of $1.08 trillion at the end of July.

- ETFs and ETPs listed in Europe reported net inflows of US$17.47 billion during July.

- Year-to-date net inflows are $50.14 Bn which is less than the $62.65 Bn gathered at this point last year.

- Equity ETFs/ETPs listed in Europe attracted the biggest part of net inflows during July with $9.48 billion.

“The S&P 500 gained 5.6% in July, aided by the U.S. Federal Reserve stimulus and strong earnings. International markets also gained, with Developed Ex-U.S. and Emerging up 3.0% and 8.5%, respectively. In the developed markets Scandinavian countries benefited most, led by Norway (up 10.8%) and Sweden (up 10.1%); while Japan (down 2.0%) was the sole negative performer among developed countries. Dollar weakness contributed toward the positive momentum in Emerging markets where 19 of 25 countries gained, led by Brazil (up 14.4%) and Pakistan (up 13.4%), while Taiwan (up 12.1%) neared an all-time high.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

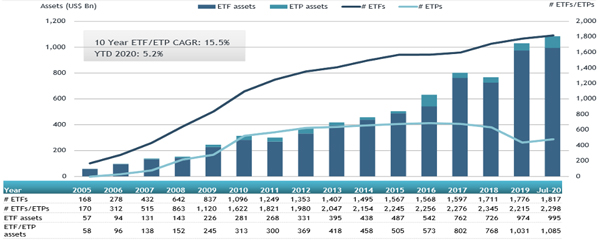

Europe ETFs and ETPs asset growth as at the end of July 2020

At the end of July 2020, the European ETF/ETP industry had 2,298 ETFs, with 8,662 listings, assets of $1.08 trillion, from 68 providers listed on 28 exchanges in 23 countries.

Equity ETFs/ETPs listed in Europe reported net inflows of $9.47 billion during July, bringing net inflows for the year 2020 to $7.67 billion, lower than the $16.53 billion in net inflows at this point in 2019. Fixed Income ETFs/ETPs listed in Europe had net inflows of $5.26 billion during July, bringing net inflows for the year to $25.76 billion, lower than the $38.28 billion in net inflows at this point in 2019. Commodity ETFs/ETPs gathered $1.59 million in net inflows bringing net inflows to $16.75 billion for 2020, which is much higher than the $4.90 billion in net inflows gathered year to date at this point in 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $9.46 billion during July. The iShares Core € Corp Bond UCITS ETF (IEBC LN) gathered $808 million alone.

Top 20 ETFs by net inflows in July 2020: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

15896.51 |

455.28 |

808.34 |

|

Xtrackers MSCI USA UCITS ETF (EUR) - Acc |

XD9E GY |

1018.16 |

112.80 |

804.55 |

|

UBS ETF (LU) MSCI EMU UCITS ETF (EUR) A - USD Hdg |

EMUUSD SW |

637.69 |

673.86 |

673.35 |

|

Vanguard S&P 500 UCITS ETF - Acc - Acc |

VUAA LN |

990.96 |

785.96 |

622.44 |

|

Amundi MSCI Emerging ESG Leaders UCITS ETF DR - Acc |

SADM GY |

621.43 |

594.36 |

588.82 |

|

UBS ETF (LU) MSCI EMU UCITS ETF (EUR) A-dis - Acc |

EMUAA SW |

1805.70 |

577.12 |

551.38 |

|

UBS ETF (LU) MSCI EMU UCITS ETF (EUR) A - CHF Hdg Acc |

EMUCHF SW |

536.31 |

548.21 |

547.62 |

|

PIMCO Euro Short Maturity Source UCITS ETF - Acc |

PJSR GY |

1114.16 |

659.20 |

465.76 |

|

UBS ETF (IE) MSCI Emerging Markets SF UCITS ETF (USD) A-acc - Acc |

EGUSAS SW |

573.26 |

(215.55) |

443.28 |

|

Xtrackers MSCI USA UCITS ETF (CHF) - CHF Hdg - Acc |

XD9C SW |

485.40 |

(0.15) |

417.07 |

|

Xtrackers Euro Stoxx 50 UCITS ETF - Acc |

XESC GY |

3874.81 |

793.15 |

409.81 |

|

iShares $ Corp Bond UCITS ETF |

LQDE LN |

8709.56 |

3304.32 |

404.16 |

|

iShares MSCI World EUR Hedged UCITS ETF (Acc) |

IWDE LN |

3291.86 |

1111.19 |

377.58 |

|

iShares $ Treasury Bond 3-7yr UCITS ETF - USD D - Acc |

CSBGU7 SW |

2398.77 |

(33.94) |

370.69 |

|

iShares US Aggregate Bond UCITS ETF - Acc |

IUAA LN |

2159.98 |

782.61 |

362.20 |

|

Xtrackers MSCI USA Index UCITS ETF (DR) - 1C - Acc |

XD9U GY |

5525.95 |

(32.30) |

358.43 |

|

Invesco S&P 500 ETF - Acc |

SPXS LN |

7856.92 |

407.13 |

350.83 |

|

iShares Core EURO STOXX 50 UCITS ETF (DE) |

SX5EEX GY |

5719.58 |

(959.14) |

313.13 |

|

AMUNDI MSCI EM ASIA UCITS ETF - USD (C) - Acc |

AASU FP |

1079.46 |

282.09 |

310.79 |

|

iShares $ Corp Bond UCITS ETF - Acc |

LQDA LN |

2592.63 |

1040.75 |

277.41 |

The top 10 ETPs by net new assets collectively gathered $2.49 billion during July. The Invesco Physical Gold ETC - Acc (SGLD LN) gathered $696 billion alone.

Top 10 ETPs by net inflows in July 2020: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

13459.26 |

3653.21 |

696.39 |

|

iShares Physical Gold ETC - Acc |

SGLN LN |

14962.20 |

5020.75 |

580.79 |

|

SG ETC WTI Oil -1x Daily Short Collateralized - Acc |

OIL1S IM |

329.41 |

320.12 |

320.12 |

|

Xetra Gold EUR - Acc |

4GLD GY |

14366.32 |

1306.01 |

312.43 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

3944.81 |

2200.89 |

158.98 |

|

Xtrackers Physical Gold Euro Hedged ETC - Acc |

XAD1 GY |

4034.98 |

532.01 |

116.54 |

|

WisdomTree Physical Silver - Acc |

PHAG LN |

2100.77 |

283.42 |

95.17 |

|

Xtrackers IE Physical Gold ETC Securities - GBP Hdg Acc |

XGDG LN |

94.16 |

398.49 |

79.73 |

|

iShares Physical Silver ETC - Acc |

SSLN LN |

515.13 |

222.47 |

70.70 |

|

WisdomTree Physical Platinum - Acc |

PHPT LN |

526.45 |

24.82 |

56.75 |

Investors have tended to invest in Equity ETFs and ETPs during July.