ETFGI Reports Actively Managed ETFs Hit Record US$1.92Tr As 2025 Marks Highest Ever Inflows And 69th Consecutive Month Of Growth

ETFGI reports Actively Managed ETFs Hit Record US$1.92Tr as 2025 Marks Highest‑Ever Inflows and 69th Consecutive Month of Growth. During December the actively managed ETFs industry globally gathered net inflows of US$56.23 billion, bringing 2025 net inflows to a record US$637.47 billion, according to ETFGI's December 2025 Active ETF industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.) ETFGI is a leading independent research and consultancy firm renowned for its expertise in subscription research, consulting services, events, and ETF TV on global ETF industry trends.

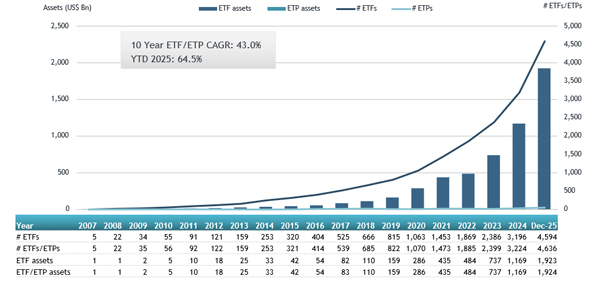

- Global assets in actively managed ETFs reached a new all‑time high of $1.92 trillion at the end of December, surpassing the previous record of $1.86 trillion set in November 2025.

- Assets rose 64.5% year‑to‑date in 2025, increasing from $1.17 trillion at the end of 2024 to $1.92 trillion.

- December 2025 saw net inflows of $56.23 billion.

- Year‑to‑date net inflows of $637.47 billion set a new record, exceeding the prior highs of $373.54 billion in 2024 and $183.40 billion in 2023.

- December marked the 69th consecutive month of net inflows.

- Actively managed equity ETFs and ETPs attracted $33.31 billion in net inflows in December.

“The S&P 500 rose 0.06% in December, finishing 2025 up 17.88%. Developed markets outside the United States gained 3.30% in December and increased 35.10% over the full year, with Korea (+10.98%) and Austria (+7.89%) posting the strongest monthly gains among developed countries. Emerging markets advanced 1.63% in December and were up 24.39% in 2025, led by Peru (+9.87%) and South Africa (+9.49%), which recorded the largest increases among emerging markets during the month.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth in assets in the actively managed ETFs industry as of end of December

The actively managed ETFs industry globally had 4,636 ETFs, with 6,152 listings, assets of $1.92 Tn, from 665 providers listed on 46 exchanges in 36 countries at the end of 2025.

In December, globally listed, actively managed equity ETFs recorded $33.31 billion in net inflows, lifting total inflows for the year to $361.33 billion, significantly higher than the $211.34 billion accumulated in 2024.

Actively managed fixed income ETFs also saw strong demand, bringing in $18.56 billion during December and reaching $237.93 billion in year‑to‑date inflows—well above the $139.69 billion recorded in 2024.

Substantial inflows can be attributed to the top 20 active ETFs by net new assets, which collectively gathered $15.89 Bn during December. JPMorgan Active Bond ETF (JBND US) gathered $1.19 Bn, the largest individual net inflow.

Top 20 actively managed ETFs/ETPs by net new assets December 2025

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

JPMorgan Active Bond ETF |

JBND US |

5,442.01 |

4,236.20 |

1,187.48 |

|

Capital Group Dividend Value ETF |

CGDV US |

26,596.71 |

10,364.07 |

1,128.24 |

|

ERShares Private-Public Crossover ETF |

XOVR US |

1,487.21 |

1,240.03 |

1,098.34 |

|

iShares U.S. Equity Factor Rotation Active ETF |

DYNF US |

31,041.99 |

13,640.67 |

1,063.15 |

|

JPMorgan Nasdaq Equity Premium Income ETF |

JEPQ US |

32,616.08 |

10,448.94 |

1,054.63 |

|

MIRAE ASSET TIGER DECEMBER MATURITY ROLLOVER FINANCIAL BOND ACTIVE ETF |

0139F0 KS |

900.81 |

887.40 |

887.40 |

|

JPMorgan Ultra-Short Municipal Income ETF |

JMST US |

6,381.28 |

3,281.73 |

825.11 |

|

Neos Nasdaq-100 High Income ETF |

QQQI US |

7,417.83 |

6,524.23 |

821.68 |

|

Avantis Emerging Markets Equity ETF |

AVEM US |

16,042.25 |

6,096.54 |

815.46 |

|

Blackrock Flexible Income ETF |

BINC US |

15,149.55 |

8,169.41 |

786.42 |

|

PGIM AAA CLO ETF |

PAAA US |

6,197.21 |

4,503.75 |

683.13 |

|

Fidelity Total Bond ETF |

FBND US |

23,443.69 |

6,073.07 |

681.65 |

|

AB US Equity ETF |

XCHG US |

660.10 |

658.82 |

658.82 |

|

Yuanta Global AI New Economy Active ETF |

00990A TT |

646.66 |

646.66 |

646.66 |

|

PIMCO Multi Sector Bond Active ETF |

PYLD US |

10,218.69 |

7,357.37 |

641.57 |

|

Goldman Sachs Technology Opportunities ETF |

GTOP US |

622.42 |

630.53 |

630.53 |

|

NEOS S&P 500 High Income ETF |

SPYI US |

6,878.96 |

4,058.58 |

605.50 |

|

Fuh Hwa Taiwan Future 50 Active ETF |

00991A TT |

567.21 |

567.21 |

567.21 |

|

Capital Group Growth ETF |

CGGR US |

19,052.86 |

7,274.85 |

557.49 |

|

JPMorgan Core Plus Bond ETF |

JCPB US |

9,322.25 |

4,228.57 |

549.41 |

Investors have tended to invest in Equity actively managed ETFs/ETPs during December.