ETFGI Reports Assets Of US$280.09 Billion Invested In Thematic ETFs Listed Globally At The End Of February

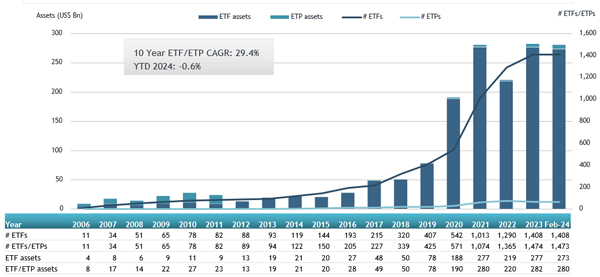

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported assets of US$280.09 billion invested are invested in Thematic ETFs listed globally at the end of February. Thematic ETFs listed globally reported net outflows of US$2.49 billion during February, bringing year to date net outflows to US$1.03 billion. Assets have decreased by 0.6% YTD in 2024, going from $281.81 Bn at end of 2023 to $280.09 Bn, according to ETFGI’s February 2024 ETF and ETP Thematic industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets of $280.09 Bn invested in Thematic ETFs listed globally at the end of February.

- Assets decreased by 0.6% YTD in 2024, going from $281.81 Bn at end of 2023 to $280.09 Bn.

- Net outflows of $2.49 Bn during February.

- YTD net outflows of $1.03 Bn are the eleventh highest on record, while the highest recorded YTD net inflows were $46.96 Bn for 2021, followed by YTD net inflows of $8.50 Bn in 2022 and YTD net inflows of $7.47 Bn in 2020.

“The S&P 500 index increased by 5.34% in February and is up by 7.11% YTD. Developed markets excluding the US increased by 1.90% in February and are up 1.58% YTD. Ireland (up 8.60%) and Israel (up 8.27%) saw the largest increases amongst the developed markets in February. Emerging markets increased by 4.18% during February and are up 0.57% YTD. China (up 8.41%) and Peru (up 7.12%) saw the largest increases amongst emerging markets in February”, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Thematic ETFs listed globally asset growth as of end of February

Since the launch of the first Thematic ETF in 2001, the iShares North American Natural Resources ETF, the number and diversity of products have increased steadily. At the end of February, Thematic ETFs listed globally had 1,473 ETFs, with 2,856 listings, assets of $280.09 Bn, from 261 providers listed on 48 exchanges in 37 countries. During February, 8 new Thematic ETFs were launched.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $3.54 Bn during February. E Fund CSI Science and Technology Innovation Board 50 ETF (588080 CH) gathered $630.77 Mn, the largest individual net inflow.

Top 20 Thematic ETFs by net new assets February 2024

|

ame |

Ticker |

Assets ($ Mn) Feb-24 |

NNA ($ Mn) YTD-24 |

NNA ($ Mn) Feb-24 |

|

E Fund CSI Science and Technology Innovation Board 50 ETF |

588080 CH |

5,054.55 |

859.67 |

630.77 |

|

Amundi S&P 500 Climate Net Zero Ambition PAB UCITS ETF |

ZPA5 GY |

3,536.89 |

605.04 |

557.72 |

|

First Trust NASDAQ CEA Cybersecurity ETF |

CIBR US |

6,862.41 |

503.59 |

327.20 |

|

Xtrackers Artificial Intelligence & Big Data UCITS ETF - Acc |

XAIX GY |

2,546.78 |

601.08 |

265.03 |

|

UBS Irl ETF plc - MSCI World Small Cap Socially Responsible UCITS ETF - Acc |

WSCSRI SW |

469.79 |

264.61 |

241.62 |

|

BNP Paribas Easy ECPI Global ESG Infrastructure Equity UCITS ETF - USD Acc |

XU61 GY |

238.92 |

236.19 |

236.19 |

|

Global X Artificial Intelligence & Technology ETF |

AIQ US |

1,361.20 |

383.36 |

168.64 |

|

E FundSI Artificial Intelligence ETF |

159819 CH |

861.74 |

201.51 |

167.19 |

|

Amplify U.S. Alternative Harvest ETF |

MJUS US |

113.19 |

142.39 |

142.39 |

|

AdvisorShares Pure US Cannabis ETF |

MSOS US |

918.15 |

190.53 |

112.53 |

|

Amundi MSCI World Climate Net Zero Ambition PAB UCITS ETF - Acc |

PABW GY |

532.99 |

99.72 |

91.27 |

|

Global X Funds-Global X Robotics & Artificial Intelligence Thematic Etf |

BOTZ US |

2,655.31 |

(39.85) |

80.04 |

|

UBS ETF CH - MSCI Switzerland IMI Dividend ESG ETF |

CHDIV SW |

88.93 |

76.21 |

75.21 |

|

SAMSUNG KODEX Secondary Battery Industry Leverage ETF |

462330 KS |

158.87 |

94.23 |

72.31 |

|

iShares Core FTSE Global Infrastructure (AUD Hedged) ETF |

GLIN AU |

187.53 |

110.16 |

69.74 |

|

Global X Uranium ETF |

URA US |

2,708.35 |

300.70 |

68.72 |

|

iShares S&P 500 Paris-Aligned Climate UCITS ETF |

UPAB NA |

409.65 |

71.93 |

62.41 |

|

L&G Artificial Intelligence UCITS ETF - Acc |

AIAG LN |

670.85 |

88.43 |

58.80 |

|

CPIC SSE Science and Technology Innovation Board 50 ETF |

588180 CH |

402.39 |

73.09 |

55.81 |

|

TIMEFOLIO TIMEFOLIO Global Artificial Intelligence Active ETF |

456600 KS |

122.58 |

47.25 |

55.6 |