ETFGI Reports Assets Invested In The ETFs Listed In Latin America Were US$22.16 Billion At The End Of February

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that assets invested in ETFs listed in Latin America were US$22.16 billion at the end of February. ETFs listed in the Latin American region reported net inflows of US$195.98 million during February, bringing year-to-date net inflows to US$327.27 million, according to ETFGI's February 2024 Latin American ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

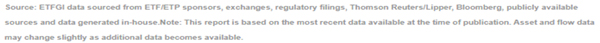

Assets and net inflows for ETFs listed in Latin America only include ETFs with their primary listing in Latin America. The assets and net inflows for ETFs that have a cross listing in Latin America are counted in the country of the primary listing of the ETF. The chart below shows the number of primary listings in the column # ETFs while total listings includes the number of primary plus all cross listings. Investors in Latin America are significant investors in ETFs listed in the US and in Europe.

To learn more Register to join our 5th Annual ETFGI Global ETFs Insights Summit - Latin America – on May 28th in Mexico City.

ETFs listed in Latin America as of the end of February

Highlights

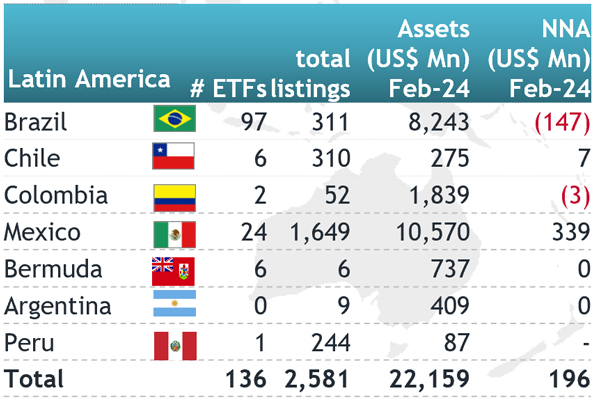

- Assets of $22.16 Bn invested in ETFs listed in Latin America at the end of February.

- Assets invested in ETFs listed in Latin America decreased 2.8% YTD in 2024, going from $22.80 Bn at end of 2023 to $22.16 Bn.

- Net inflows of $195.98 Mn in February.

- YTD net inflows of $327.27 Mn were the fifth highest on record while the highest recorded YTD net inflows were $1.38 Bn in 2020 followed by YTD net inflows of $622.73 Mn in 2021.

- 4th month of net inflows.

“The S&P 500 index increased by 5.34% in February and is up by 7.11% YTD. Developed markets excluding the US increased by 1.90% in February and are up 1.58% YTD. Ireland (up 8.60%) and Israel (up 8.27%) saw the largest increases amongst the developed markets in February. Emerging markets increased by 4.18% during February and are up 0.57% YTD. China (up 8.41%) and Peru (up 7.12%) saw the largest increases amongst emerging markets in February”, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Latin American ETF asset growth as of the of February

At the end of February, the Latin American ETF industry had 136 ETFs, with 2,581 listings, assets of $22.16 Bn, from 72 providers listed on 7 exchanges.

During February, ETFs reported net inflows of $195.98 Mn. Equity ETFs reported net outflows of $40.39 Mn during February, bringing YTD net outflows to $329.48 Mn, lower than the $408.55 Mn in net outflows YTD in 2023. Fixed income ETFs gathered net inflows of $215.86 Mn during February, bringing YTD net inflows to $383.86 Mn, much higher than $16.23 Mn in net outflows YTD in 2023.

Substantial inflows can be attributed to the top 10 ETFs by net new assets, which collectively gathered

$482.85 Mn during February iShares NAFTRAC (NAFTRAC MM) gathered $177.36 Mn, the largest individual net inflow.

Top 10 ETFs/ETPs by net new assets February 2024: Latin America

|

ame |

Ticker |

Assets |

NNA |

NNA |

|

iShares NAFTRAC |

NAFTRAC MM |

4,807.65 |

449.32 |

177.36 |

|

Vanguard US Treasury 0-1 Year Bond UCITS ETF - MXN Hdg Acc |

VMSTXN MM |

2,152.39 |

263.21 |

144.94 |

|

JPMorgan Betabuilders US Treasury Bond 0-3 Months UCITS ETF |

MB3MN MM |

282.79 |

112.32 |

64.31 |

|

MEXTRAC - Acc |

MEXTRAC MM |

820.95 |

13.95 |

20.18 |

|

Vanguard FTSE BIVA Mexico Equity ETF - Acc |

VMEX MM |

251.80 |

13.14 |

14.84 |

|

It Now IMA-B 5 P2 |

B5P211 BZ |

105.32 |

14.13 |

14.13 |

|

BB ETF Ibovespa Fundo de Indice |

BBOV11 BZ |

317.36 |

13.93 |

13.93 |

|

ETF BRADESCO IBOVESPA FDO DE INDICE |

BOVB11 BZ |

296.69 |

12.96 |

12.96 |

|

TREND ETF NASDAQ 100 |

NASD11 BZ |

54.76 |

14.78 |

11.55 |

|

iShares S&P 500 Peso Hedged Trac - Acc |

IVVPESO MM |

305.15 |

43.81 |

8.66 |